Top 10 Home Insurance Companies in Texas. When it comes to protecting your home, choosing the right insurance plan is crucial, especially in a state like Texas where natural disasters such as hurricanes,

floods, and wildfires can pose a significant threat. Home insurance provides the financial safety net you need when unexpected events occur,

covering damage to your home, personal belongings, and other liabilities. However, with so many insurance companies offering various plans, finding the best home insurance in Texas can be a challenge.

In this article, we will review the top 10 home insurance companies in Texas. Each company is evaluated based on coverage options, customer service,

claims process, pricing, and customer reviews. Let’s take a look at which companies stand out and what they offer to homeowners in Texas.

1. State Farm

Overview

Top 10 Home Insurance Companies in Texas. State Farm is one of the largest and most reputable insurance providers in the U.S. It is known for its reliable customer service and extensive coverage options.

For Texas homeowners, State Farm offers a wide range of policies that cover everything from dwelling protection to personal property and liability coverage.

Key Features

State of Florida Workers Compensation Insurance

- Customizable Coverage: State Farm allows policyholders to customize their insurance plan by adding optional coverage for specific needs, such as identity theft and water backup.

- Discounts: You can lower your premium through various discounts, such as bundling home and auto insurance or installing security devices.

- User-Friendly Mobile App: The State Farm mobile app allows policyholders to manage claims, pay bills, and even file for claims directly from their smartphones.

Pros

- Nationwide reputation and stability

- Multiple discount opportunities

- Comprehensive customer service and claims handling

Cons

- Premiums can be higher than competitors for some customers

Customer Reviews

Top 10 Home Insurance Companies in Texas. Customers praise State Farm for its straightforward claims process and attentive customer service, though some report higher premiums compared to other companies.

2. Allstate

Overview

Allstate is a well-known home insurance provider offering robust coverage options with several additional policy features that cater to Texas homeowners.

From protection against windstorms to water damage, Allstate’s policies cover a wide range of risks.

Key Features

- Claim Rateguard: Allstate’s exclusive Claim Rateguard feature prevents your premium from increasing after filing a single claim.

- Deductible Rewards Program: Allstate offers a reward program that reduces your deductible by $100 for every year you don’t file a claim, up to a maximum of $500.

- Flood Insurance Options: While flood damage isn’t covered in standard home insurance policies, Allstate offers optional flood insurance for areas prone to flooding, a useful feature in Texas.

Pros

- Wide range of customizable policy options

- Offers valuable perks like Claim Rateguard

- Strong mobile app and online account management

Cons

- Higher premiums, especially for those living in areas with frequent weather risks

Customer Reviews

New Hampshire Home Insurance Rates

Allstate’s customer service is often praised, particularly for its responsiveness and helpfulness during the claims process. However,

some customers note that premiums tend to be on the higher end.

3. USAA

Overview

USAA is a highly regarded insurance company but is only available to military members and their families. If you qualify, USAA offers some of the best home insurance coverage,

particularly for Texas residents living near military installations or in high-risk areas for natural disasters. Top 10 Home Insurance Companies in Texas.

Key Features

- Comprehensive Disaster Coverage: USAA covers a variety of natural disasters common in Texas, including wind, hail, and even floods.

- Replacement Cost Coverage: Policies include replacement cost coverage for both the home and personal belongings, ensuring you receive full reimbursement for damaged items.

- Financial Strength: USAA is consistently rated highly for its financial strength and ability to pay out claims efficiently.

Pros

- Highly competitive rates for military members

- Excellent coverage for natural disasters

- High satisfaction with claims process

Cons

- Only available to military members and their families

Customer Reviews

USAA is often rated as one of the top insurers in the country for customer satisfaction, with policyholders citing its affordable premiums and effective claims handling as major advantages.

4. Farmers Insurance

Overview

Farmers Insurance is a popular choice among Texans for its customizable home insurance policies. It offers standard home coverage along with a variety of add-ons to cover unique needs.

Key Features

- Declining Deductibles: Farmers offers a declining deductible feature, which reduces your deductible over time for every year you don’t file a claim.

- Eco-Rebuild Coverage: Farmers provides optional coverage that helps pay for environmentally friendly or sustainable rebuilding options after a claim.

- Flood and Windstorm Coverage: Farmers offers additional protection for Texas residents who live in flood- and wind-prone areas.

Pros

- Highly customizable policies

- Unique features like eco-rebuild coverage

- Comprehensive add-on options

Cons

- Higher premiums in certain areas

- Some customers experience slow claims processing

Customer Reviews

Farmers receives mixed reviews for its customer service and claims process. While many customers appreciate the flexibility in policy options, some have reported delays in claims settlements.

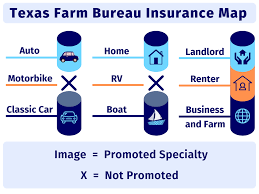

5. Texas Farm Bureau Insurance

Overview

Texas Farm Bureau Insurance is a state-specific insurer that provides affordable home insurance options for Texas residents. It’s known for its low premiums and personalized service.

Key Features

- Affordable Rates: Texas Farm Bureau is known for offering some of the most competitive rates in the state.

- Localized Knowledge: As a Texas-based insurer, it understands the specific risks and needs of homeowners in different parts of the state.

- Discount Opportunities: Policyholders can take advantage of discounts for having multiple policies, such as auto insurance, and for making home improvements.

Pros

- Affordable premiums

- Local expertise tailored to Texas risks

- Discounts for bundling policies

Cons

- Limited coverage options compared to national insurers

- Smaller company size may limit claim processing speed

Customer Reviews

Texas Farm Bureau receives high marks for affordability and customer service, with many customers praising the company’s understanding of local needs.

However, it may not offer as many policy options as some of the larger insurers.

6. Liberty Mutual

Overview

Liberty Mutual is another top contender for home insurance in Texas, offering flexible coverage options and strong customer support.

Key Features

- Comprehensive Personal Property Coverage: Liberty Mutual provides replacement cost coverage for personal property, ensuring that you’re fully reimbursed in case of a loss.

- Discounts for Safety Devices: You can receive discounts for installing home safety devices like burglar alarms or smoke detectors.

- Hurricane and Storm Damage Protection: Texas homeowners can add optional storm damage coverage, a critical addition given the state’s susceptibility to hurricanes.

Pros

- Multiple discount options

- Strong financial stability

- Customizable policies for Texas residents

Cons

- Premiums can vary significantly depending on location

Customer Reviews

Liberty Mutual is praised for its user-friendly online tools, making it easy for customers to manage their policies and file claims. Some, however, have expressed dissatisfaction with fluctuating premium costs.

7. Chubb

Overview

Chubb is a premium home insurance provider that caters to high-value homeowners. If you own a luxury or historic home in Texas,

Chubb offers extensive coverage options that may not be available through other providers.

Key Features

- Extended Replacement Cost Coverage: Chubb provides policies that cover not only the cost to rebuild your home but also extended replacement costs if construction costs rise unexpectedly.

- Cash Settlement Option: If you choose not to rebuild after a loss, Chubb offers a cash settlement option, which allows you to receive the insured amount as a lump sum.

- High-Value Personal Property Coverage: Chubb also offers specialized coverage for high-value items such as jewelry, art, and antiques.

Pros

- Comprehensive coverage for high-value homes

- Excellent customer service and claims handling

- Cash settlement option for total losses

Cons

- Premiums are higher compared to other insurers

- Not ideal for those with standard home insurance needs

Customer Reviews

Chubb customers often highlight the company’s superior claims handling and tailored coverage for high-value homes. However, the higher premiums are a notable downside for many.

8. Progressive

New Jersey Legal Malpractice Insurance

Overview

Progressive is known for its flexible and affordable home insurance plans, making it a popular choice for Texans on a budget. In addition to standard coverage,

Progressive offers various policy enhancements for additional protection.

Key Features

- Bundle Savings: Progressive offers significant discounts for bundling home and auto insurance policies.

- Customizable Coverage Limits: Policyholders can tailor their coverage limits to fit their specific needs, making it easier to find a plan within your budget.

- Water Damage Coverage: Progressive provides optional water damage coverage, which is essential for Texas homeowners living in flood-prone areas.

Pros

- Affordable premiums with bundling options

- User-friendly digital tools and mobile app

- Customizable policies

Cons

- Customer service is not as highly rated as other companies

Customer Reviews

Progressive is favored for its affordable premiums and easy-to-use mobile app. However, some customers report dissatisfaction with the responsiveness of customer service representatives.

9. Amica Mutual Insurance

Overview

Amica Mutual Insurance is renowned for its excellent customer service and solid home insurance coverage. Though not as large as some competitors,

Amica provides Texas homeowners with robust protection and high customer satisfaction.

Key Features

- Dividend Policies: Amica offers dividend policies that return a portion of the premiums to policyholders at the end of the year.

- Superior Claims Handling: Amica is known for its fast and efficient claims process.

- Bundling Discounts: Homeowners can save by bundling their home insurance with auto or other types of insurance policies.

Pros

- High customer satisfaction and service ratings

- Dividend policies offer savings opportunities

- Strong claims process